We teach Canadian and U.S creators how to make tax optional through curated planning.

Essentials

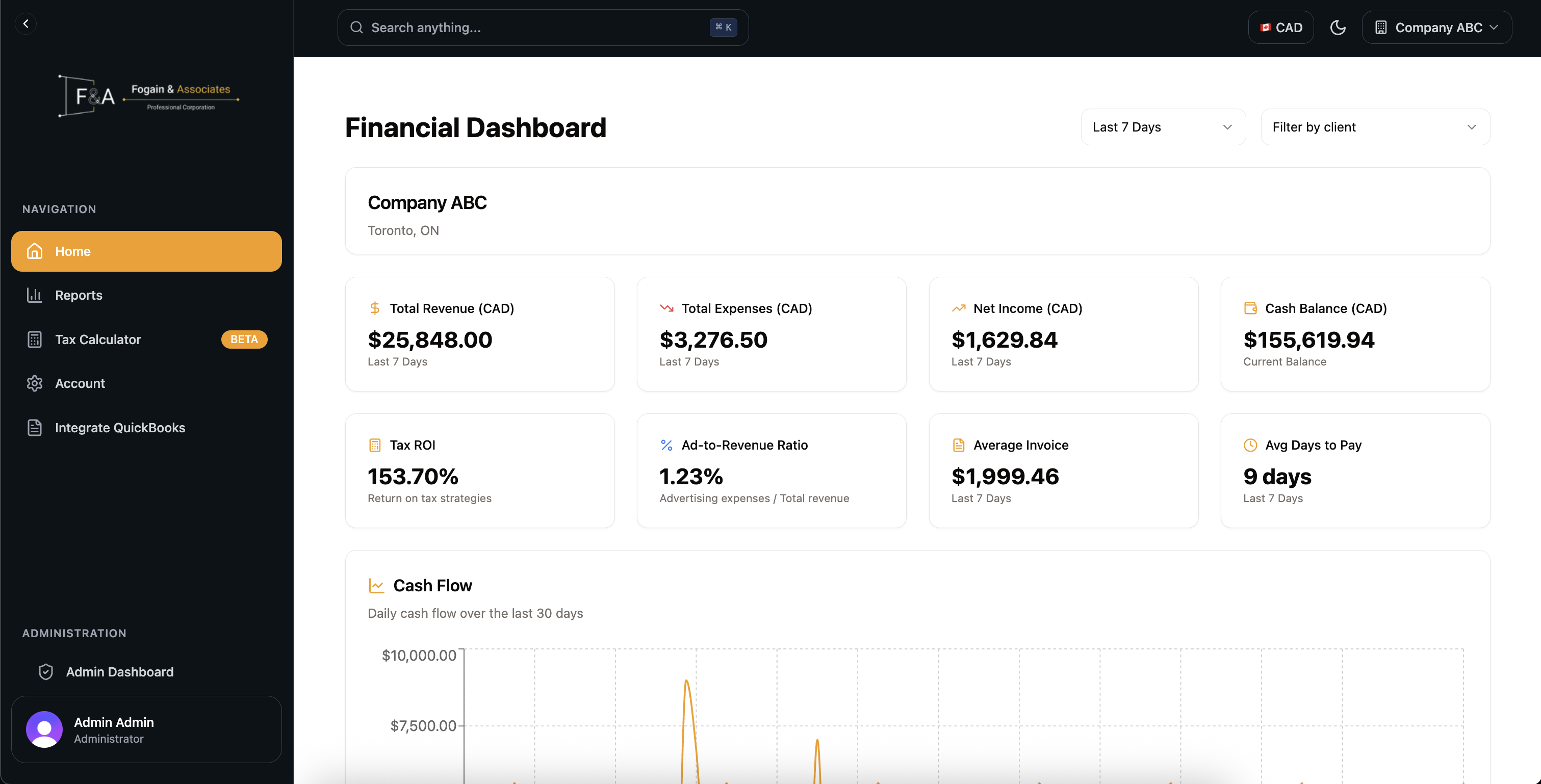

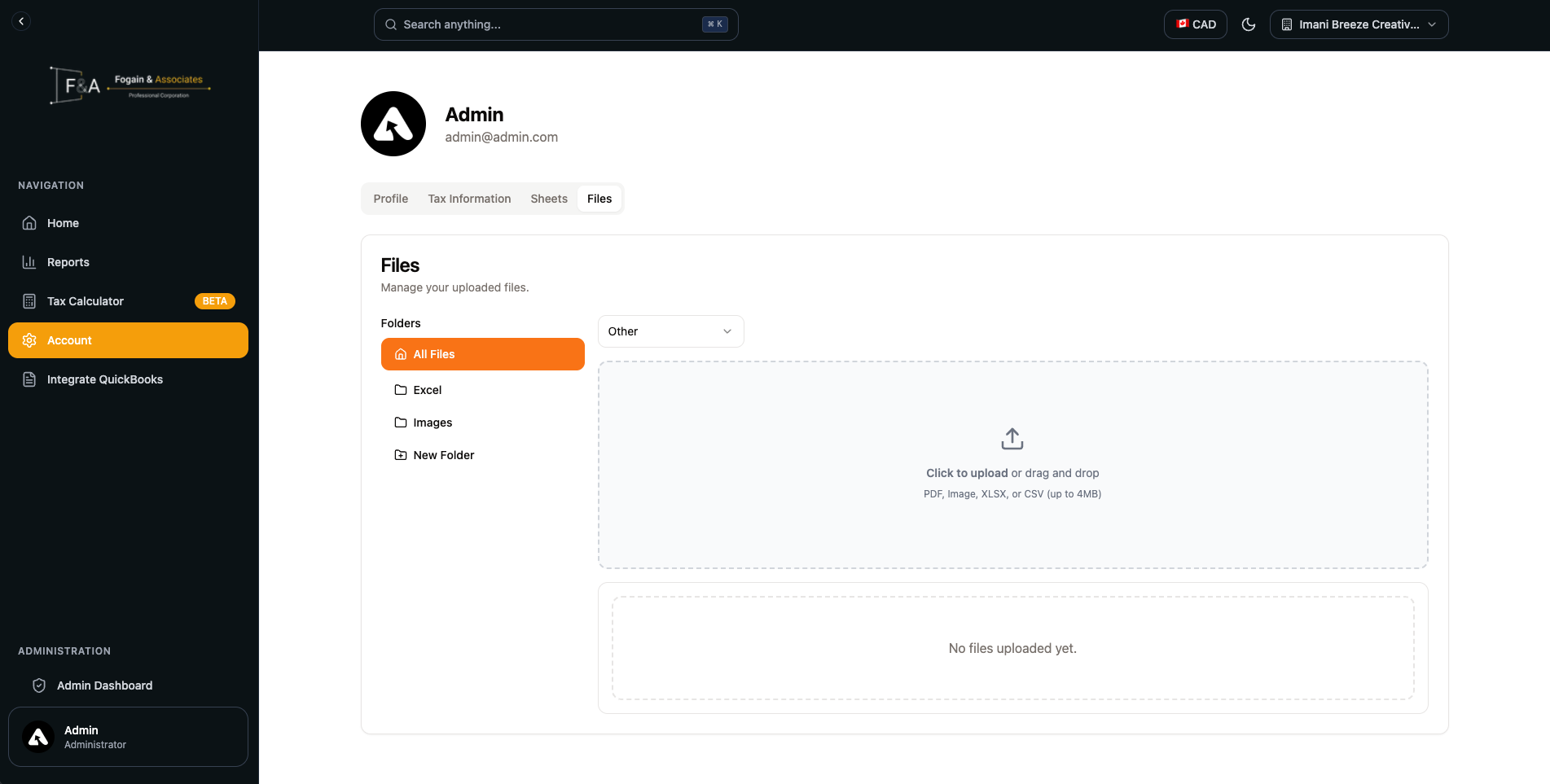

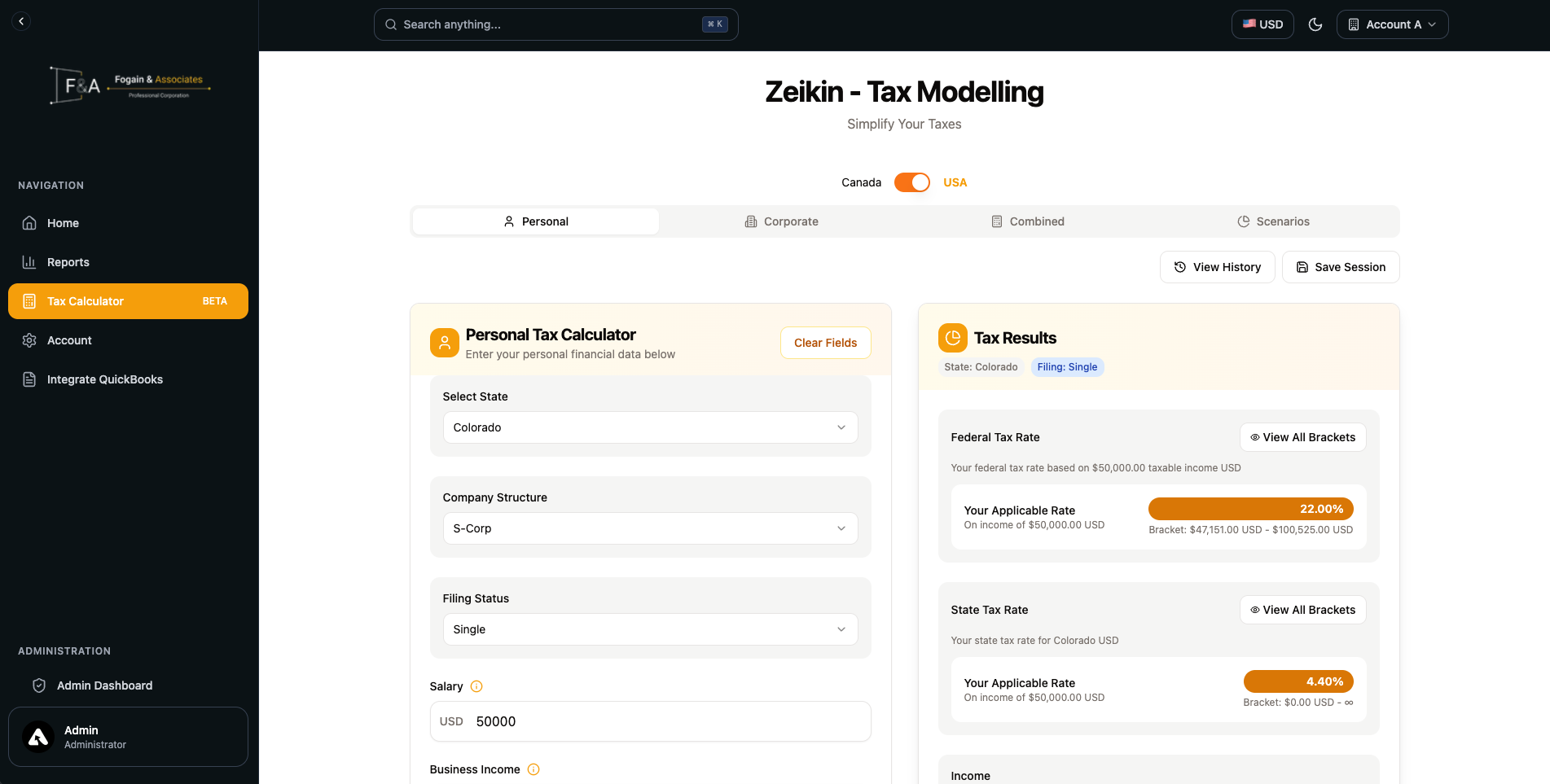

- Access to Client Portal

- All Year Tax Advice

- Monthly Bookkeeping Services - Essentials

- Personal Tax Preparation

- Quarterly Taxes

- Audit Protection

- Response Time (4 Business Days)